Lithuania crypto license

Lithuania has emerged as a Financial technology hotspot, with several entrepreneurs looking to establish themselves in Vilnius. The fundamental factor is the favorable climate for the formation of financial corporations. Although in other states, acquiring a license might take years, in Lithuania, limits and negotiations are scrupulously followed.

The features of crypto license in Lithuania

A crypto license is a legislative authority’s authorisation to engage out a specified activity. Depending on the jurisdiction, obtaining a licence, or as it is often called, a permission or certificate, necessitates a variety of criteria and restrictions, such as a mandatory minimum deposit. The Lithuania crypto license benefits all market players since explicit rules of the game safeguard all parties’ interests. Licensed labor implies more operational openness, validity, and dependability.

Extremelly Fast

Customize

Security

Opportunities of of crypto license in Lithuania

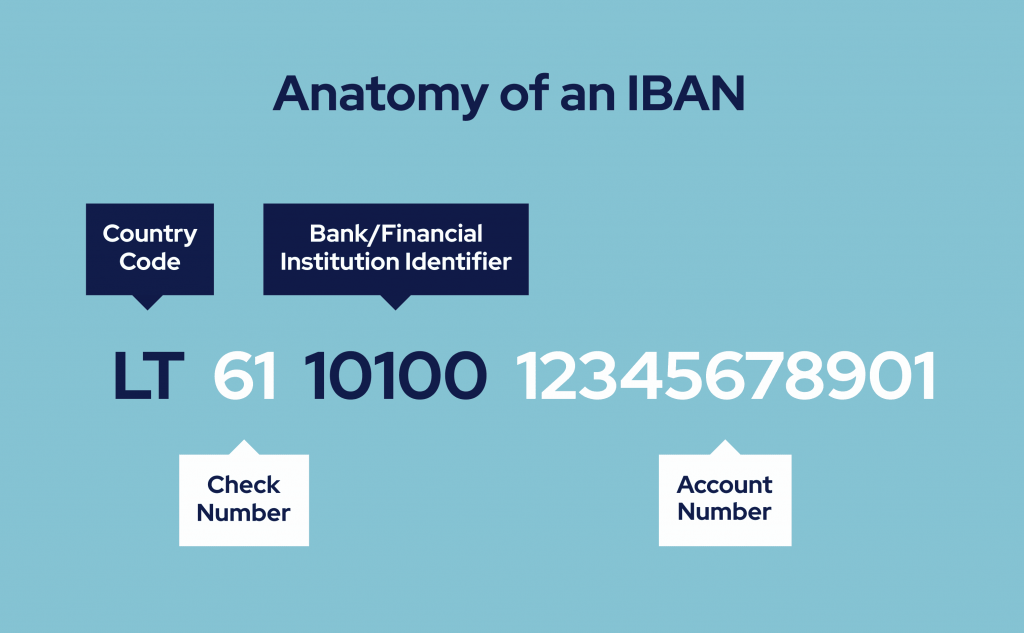

To establish customer records for both physical and legal people. To give distant financial management operations – online bank. To provide currency trading services. To generate their own IBANs. To conduct international transactions. Supply acquisition offerings. The primary distinction is that EMI may save customer balances whereas PI cannot. In many other ways, when PI gets money, it should generally know right away when and where to deliver it, but with EMI, the consumer might deposit money and then not do anything with it.

Extremely Fast

Obtaining a crypto license in Lithuania

There are two sorts of permissions that may be issued in Lithuania to deal with virtual money as well as provide services which including:

- A virtual currencies exchange service is one in which a customer swaps virtual money for fiat currency, fiat currency for digital assets, or one cryptocurrency for another.

- Crypto wallets are services that allow customers to preserve and transmit cryptographic data.

Requirements for registration of crypto license in Lithuania

- At minimum one director must be appointed. There are no criteria for the director’s lodging.

- Board member qualification criteria include the availability of education connected to the operations of financial firms or other system as shown in figure, as well as management experience in this sector.

- The number of stockholders varies from 1 and 250. Owners might be either natural or legal entities. There are no residence restrictions for stockholders.

- A valid residence in Lithuania is required.

- EUR 2,500 is the minimum allowed capital.

- Agreements with the AML officer for engagement with Lithuanian government agencies.